What Does Feie Calculator Mean?

The Greatest Guide To Feie Calculator

Table of ContentsAn Unbiased View of Feie CalculatorUnknown Facts About Feie CalculatorFeie Calculator Can Be Fun For EveryoneRumored Buzz on Feie CalculatorNot known Factual Statements About Feie Calculator 10 Simple Techniques For Feie CalculatorFeie Calculator Can Be Fun For Anyone

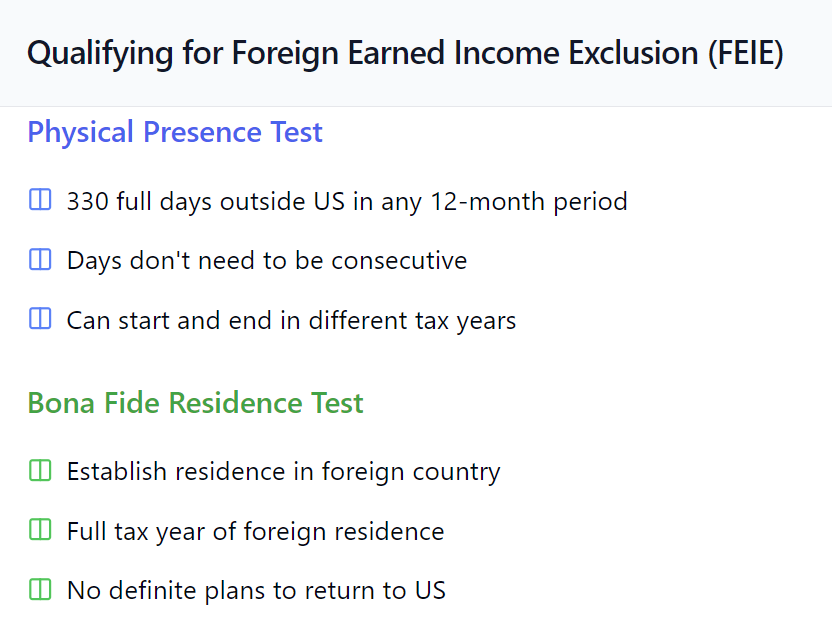

If he 'd frequently traveled, he would certainly rather finish Component III, providing the 12-month period he satisfied the Physical Presence Examination and his travel history - Bona Fide Residency Test for FEIE. Action 3: Coverage Foreign Revenue (Component IV): Mark earned 4,500 per month (54,000 each year). He enters this under "Foreign Earned Earnings." If his employer-provided real estate, its value is also consisted of.Mark calculates the exchange rate (e.g., 1 EUR = 1.10 USD) and converts his salary (54,000 1.10 = $59,400). Considering that he lived in Germany all year, the percentage of time he stayed abroad throughout the tax obligation is 100% and he gets in $59,400 as his FEIE. Finally, Mark reports total salaries on his Form 1040 and gets in the FEIE as an unfavorable quantity on Arrange 1, Line 8d, reducing his gross income.

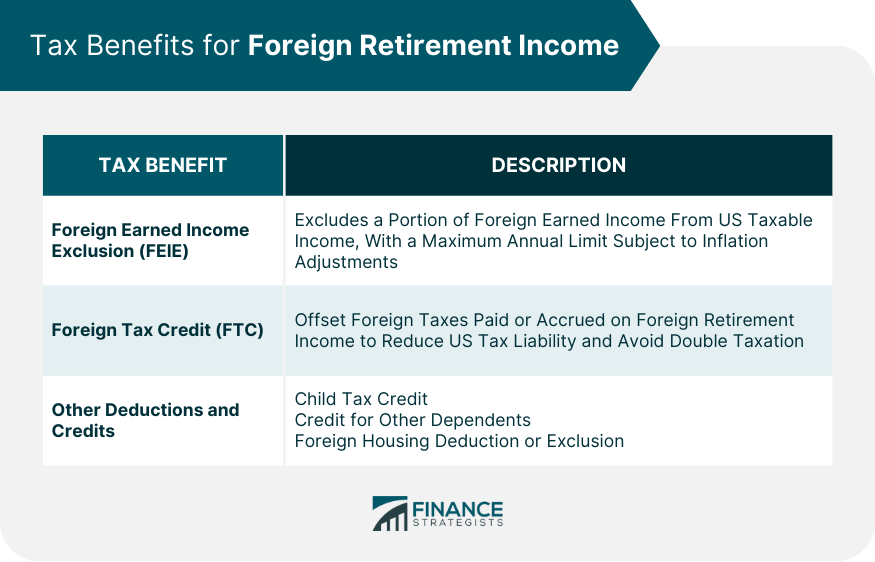

Selecting the FEIE when it's not the ideal alternative: The FEIE might not be ideal if you have a high unearned income, earn greater than the exclusion restriction, or live in a high-tax country where the Foreign Tax Obligation Credit (FTC) may be a lot more advantageous. The Foreign Tax Credit Scores (FTC) is a tax reduction technique frequently made use of along with the FEIE.

The 20-Second Trick For Feie Calculator

deportees to offset their united state tax obligation financial obligation with foreign revenue taxes paid on a dollar-for-dollar decrease basis. This indicates that in high-tax countries, the FTC can frequently remove united state tax obligation financial obligation entirely. Nonetheless, the FTC has limitations on qualified taxes and the optimum claim amount: Qualified taxes: Only revenue taxes (or tax obligations in lieu of earnings tax obligations) paid to international governments are qualified.

tax obligation obligation on your international earnings. If the foreign taxes you paid surpass this limitation, the excess international tax obligation can usually be continued for as much as 10 years or returned one year (via a changed return). Preserving precise documents of international income and taxes paid is as a result important to computing the appropriate FTC and keeping tax compliance.

expatriates to decrease their tax obligations. For example, if a united state taxpayer has $250,000 in foreign-earned earnings, they can leave out approximately $130,000 utilizing the FEIE (2025 ). The remaining $120,000 might after that undergo taxes, yet the united state taxpayer can potentially apply the Foreign Tax Credit score to offset the taxes paid to the international nation.

Feie Calculator for Beginners

He offered his United state home to establish his intent to live abroad completely and applied for a Mexican residency visa with his wife to assist accomplish the Bona Fide Residency Test. Neil aims out that purchasing home abroad can be testing without first experiencing the location.

"We'll most definitely be beyond that. Even if we return to the United States for doctor's appointments or company phone calls, I question we'll invest greater than one month in the United States in any type of given 12-month period." Neil stresses the significance of stringent tracking of united state gos to. "It's something that individuals need to be really thorough about," he states, and suggests expats to be cautious of usual errors, such as overstaying in the united site state

Neil is cautious to tension to U.S. tax obligation authorities that "I'm not performing any company in Illinois. It's just a mailing address." Lewis Chessis is a tax obligation consultant on the Harness system with considerable experience assisting U.S. residents browse the often-confusing realm of worldwide tax compliance. Among the most typical misunderstandings amongst united state

The 5-Minute Rule for Feie Calculator

income tax return. "The Foreign Tax obligation Credit score allows individuals working in high-tax nations like the UK to counter their U.S. tax responsibility by the amount they have actually currently paid in taxes abroad," states Lewis. This guarantees that deportees are not tired twice on the very same earnings. However, those in reduced- or no-tax countries, such as the UAE or Singapore, face additional difficulties.

The possibility of reduced living expenses can be alluring, yet it usually features trade-offs that aren't promptly obvious - https://www.intensedebate.com/profiles/feiecalcu. Housing, for example, can be much more affordable in some nations, but this can imply endangering on infrastructure, security, or access to reliable utilities and solutions. Inexpensive buildings may be situated in locations with irregular web, restricted mass transit, or undependable healthcare facilitiesfactors that can considerably impact your daily life

Below are some of one of the most frequently asked questions concerning the FEIE and other exemptions The Foreign Earned Revenue Exclusion (FEIE) permits U.S. taxpayers to omit as much as $130,000 of foreign-earned income from federal earnings tax, decreasing their united state tax obligation obligation. To receive FEIE, you should meet either the Physical Visibility Examination (330 days abroad) or the Bona Fide House Test (show your main residence in an international country for a whole tax obligation year).

The Physical Visibility Test also calls for United state taxpayers to have both a foreign income and an international tax home.

What Does Feie Calculator Mean?

An income tax treaty between the united state and an additional country can aid stop double taxes. While the Foreign Earned Revenue Exemption decreases gross income, a treaty might give additional advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a required declaring for united state residents with over $10,000 in foreign financial accounts.

The foreign made income exclusions, occasionally referred to as the Sec. 911 exemptions, exclude tax obligation on wages made from working abroad.

Facts About Feie Calculator Revealed

The tax obligation benefit omits the income from tax obligation at lower tax obligation prices. Formerly, the exemptions "came off the top" decreasing earnings subject to tax obligation at the leading tax rates.

These exemptions do not exempt the wages from US taxes however just offer a tax reduction. Keep in mind that a solitary person working abroad for every one of 2025 who made regarding $145,000 without other income will have gross income lowered to no - efficiently the exact same response as being "tax totally free." The exclusions are computed on a daily basis.

If you attended company meetings or seminars in the US while living abroad, revenue for those days can not be excluded. Your earnings can be paid in the US or abroad. Your employer's place or the area where earnings are paid are not consider qualifying for the exclusions. Physical Presence Test for FEIE. No. For US tax it does not matter where you keep your funds - you are taxable on your globally earnings as a United States person.